Key findings:

- Non-bank FCMs reporting revenues rising faster than any other market segments

- Cost bases rising across the industry, most notable increases in EU (excl UK) and the UK

- Brexit uncertainty a barrier to growth in the UK significantly more than it is in the EU (excl UK)

- Headcount and salaries for legal and compliance staff rising at the fastest rate

- Bonus pools are down for the sellside but up for proprietary trading groups

London — 14 April The inaugural Acuiti Derivatives Insight Report has found that the global derivatives industry reported solid revenue performance in March but also highlighted the challenges that continuing uncertainty over Brexit is bringing to the UK market.

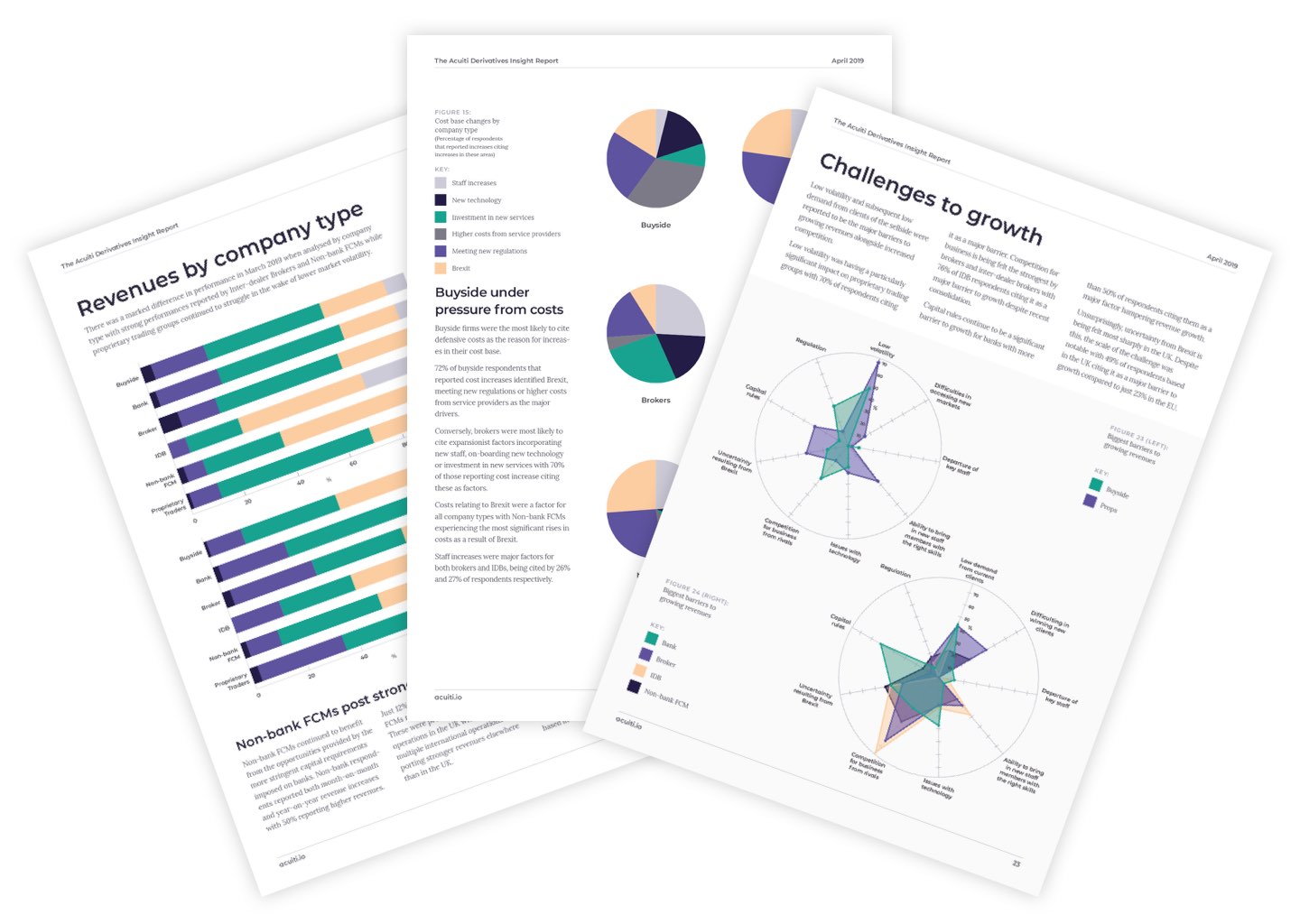

The report, which was compiled by anonymous submissions from over 140 senior derivatives professionals from across the globe, found that revenues in March 2019 had generally risen or remained constant across all markets and company types both year-on-year and month-on-month.

38% of total respondents reported month-on-month revenue increases and 33% cited a better year-on-year performance while just 17% of total respondents reported lower month-on-month revenues.

However, there is a marked difference in performance across continents with South America, APAC and the Middle East driving up revenue growth and European and UK participants experiencing headwinds.

Survey respondents in the UK reported both the most depressed revenues and the fastest rising cost bases with the majority citing uncertainty over Brexit as a primary barrier to growing revenues.

Will Mitting, managing director of Acuiti, said: “The overall performance and outlook for the derivatives market is positive but the ongoing uncertainty over Brexit is having a major impact on market participants in both the UK and Europe.

“Despite a strong month for volumes in March and a positive performance outside Europe, Brexit is causing a cloud over revenue growth and leading to sharp rises in cost bases in both the UK and the other EU countries.”

“The overall performance and outlook for the derivatives market is positive but the ongoing uncertainty over Brexit is having a major impact on market participants in both the UK and Europe.”

Non-bank FCMs and Inter-dealer brokers reported the most positive trading conditions in March with both year-on-year and month-on-month increases in revenues. Banks reported the most challenging performance.

The outlook for the industry over the next three months is positive with 58% of total respondents predicting revenues in their business to increase and 15% believing that increase will be significant.

The US is the most confident region with 73% of respondents predicting increases in revenues while 65% of respondents predict increases in the EU. The UK is the least confident region; however, a majority of respondents still believe revenues will increase (53%).

The report also covers staffing levels, barriers to growth, salary pressures and a series of other metrics.

The Acuiti Derivatives Insight Report is powered by data submitted by the Acuiti network of senior derivatives professionals across the sellside, proprietary trading and the buyside.

To download the report and get the opportunity to participate in next month’s Acuiti Derivatives Insight Report, click the image below.

The full Acuiti website will launch in May 2019.

For more information, contact Will Mitting

Tel.: +44 (0) 7553969591

Email: willmitting@acuiti.io

About Acuiti

Acuiti is a new business intelligence platform designed to provide senior executives with unparalleled insight into business operations and industry-wide performance. Acuiti helps identify market trends, enhance decision-making and benchmark company performance. The platform anonymises and aggregates information from its exclusive network of senior industry figures to provide insightful in-depth analysis.