Acuiti was commissioned by Quantile Technologies, to conduct a study into the impact and implementation of SA-CCR. In the third of four, taken from the whitepaper, we take a look at how banks are managing the implementation of SA-CCR.

For banks, SA-CCR has been a major exercise in data processing. For many firms, SA-CCR was more complicated than the models they had been using previously. In addition, SA-CCR required new automated feeds from across the bank to be built to run the calculations.

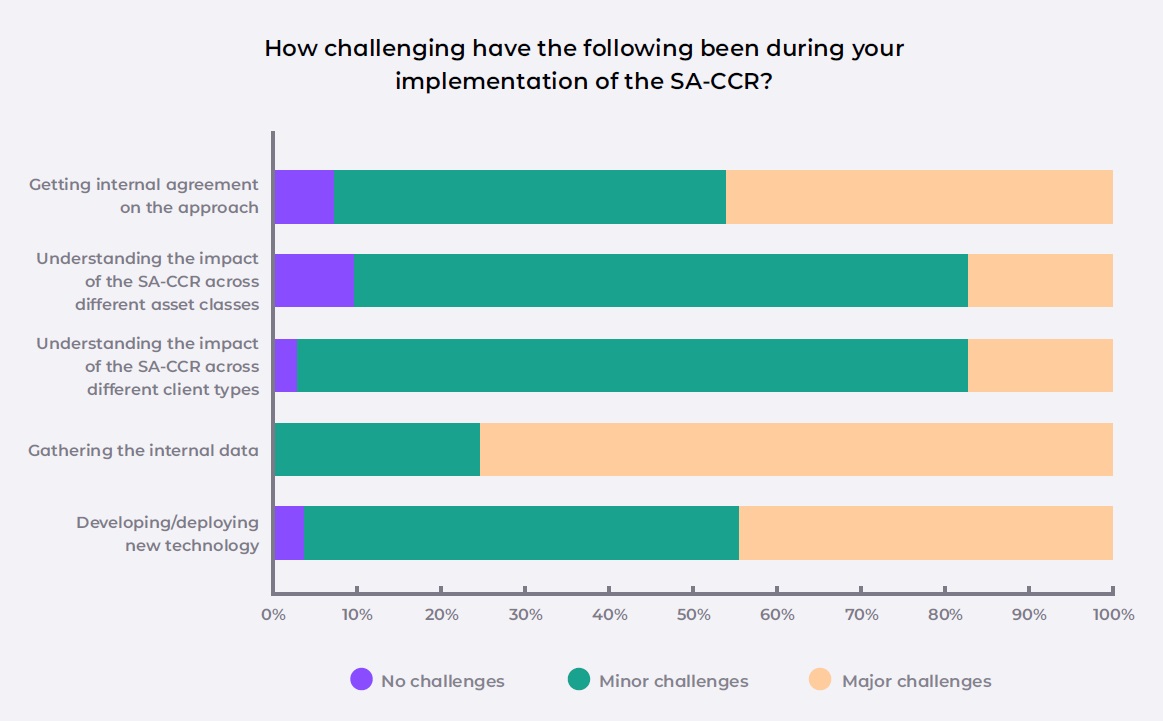

As a result, the biggest challenge for banks implementing SA-CCR as cited in the survey was gathering the internal data, with three-quarters of respondents citing it as a major challenge. SA-CCR has a wide range of impacts across banks and firms also struggled to get internal agreement on their approach, with 92% of firms reporting a challenge in this respect.

Understanding the impact of SA-CCR across different asset classes and client types posed minor challenges for most respondents, while almost half reported a major challenge in developing and deploying the technology required to make the calculations and bring in all the data feeds.

Going forward, all respondents said they intended to actively manage SA-CCR, with the majority saying they would do so internally via bilateral discussions, the use of multilateral optimisation services via a third-party, backloading positions to clearing and actively managing client portfolios to reduce their capital impact.

In the past, regulatory models and policies encouraged the use of variation margin and, to a lesser degree, initial margin between counterparties on a bilateral basis. A risk-based framework such as SA-CCR requires far greater use of a multilateral approach to risk management by matching offsetting positions across counterparties rather than improving bilateral terms of trading with single counterparties. This is expected to translate into much greater use of optimisation networks, especially in the interbank and hedge fund community.

While there were expectations of a reduction in compression to reduce notional exposures following the introduction of SA-CCR, only 13% of respondents expected a strong decrease, with 46% expecting a slight decrease.

One thing is certain – SA-CCR will bring requirements for more active risk management and a greater focus both pre- and post-trade optimisation on the capital impact of individual trades. Optimisation services will play a key role in helping banks automatically rebalance and actively manage their portfolios to improve capital efficiency.