Acuiti was commissioned by Quantile Technologies, to conduct a study into the impact and implementation of SA-CCR. In the fourth of four articles, taken from the whitepaper, we conclude that SA-CCR is an imperfect improvement on CEM and SA.

SA-CCR was born out of the global financial crisis and the failings in existing models to effectively reflect risk and volatility. While it is certainly a more risk-sensitive measure of capital requirements, it is resulting in some significant adverse consequences for certain company types and instruments.

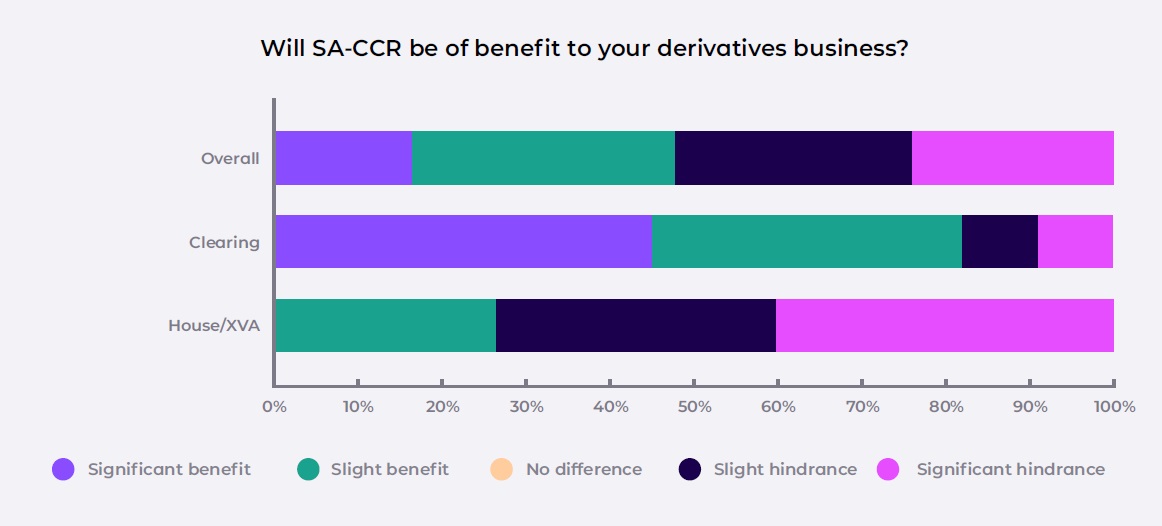

As SA-CCR creates winners and losers for asset classes and clients, so too does it for banks and specific functions within them. Respondents to the survey were almost evenly split on whether SA-CCR would benefit or hinder their business.

Those overseeing clearing businesses were the most positive, with 67% of respondents saying it would benefit their business, including 42% who thought it would be a significant benefit. However, even among clearing executives, 18% said they thought it would be a hindrance.

Those respondents overseeing house/trading business and XVA operations were the most negative, with 70% believing SA-CCR would be a hindrance to their business, including 40% who thought it would be a significant hindrance.

SA-CCR is an imperfect fix for the problems raised by CEM and SM but an improvement on the previous methodologies. However, SA-CCR was not conceived to raise the costs of participation in the derivatives market for corporates, pension funds and long-only asset managers.

Owing to the impact of increased capital requirements for these firms’ portfolios, relief should be considered to mitigate any unintended consequences and increased costs. For those participants not subject to mandatory clearing obligations, optimised backloading to a central clearing house, where only targeted risk is cleared, presents an opportunity to manage exposures prudently.

The hope is that, once implemented, changes can be made to address the major issues such as the treatment of IM and the scale of the alpha factor. More urgent changes will need to be made to the treatment of specific asset classes, with energy markets topping the list for attention.

It is essential, however, that changes are made at a global level. The move by the US regulators to remove CEUs from the alpha factor uplift, while a sensible adjustment that should be extended to other users, has raised significant concerns over the impact of bilateral changes on the level playing field.

SA-CCR will bring significant relief to some parts of the market but bring additional stresses to others. Active management of SA-CCR will be key to optimising portfolios in the post-SA-CCR world. While changes will likely come, there is much that firms can do today to mitigate the downsides of the new capital order.