Acuiti was commissioned by Quantile Technologies, to conduct a study into the impact and implementation of SA-CCR. In the second of four articles, taken from the whitepaper, we take a look at the impact across client types.

The data is based on a survey and series of interviews with over 40 banks and financial intermediaries. In order to gauge how SA-CCR would affect different asset classes and client types, Acuiti asked banks that had conducted analyses of the impact whether capital requirements would increase following its introduction.

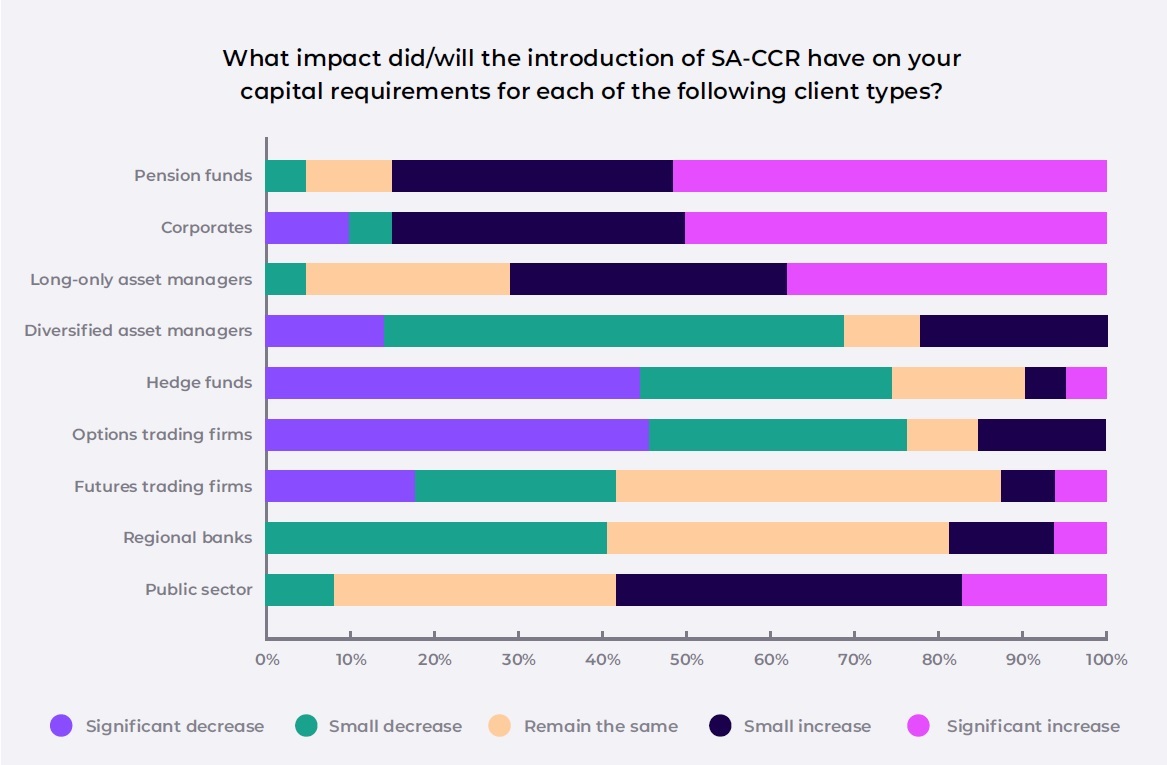

We found differing views on the impact across asset classes and client types, which reflect the complexity of SA-CCR and the wide-ranging impact it has depending on the specific portfolio of positions.

The impact on clients is naturally dependent on how and what they trade. The big losers are those with directional positions in long-dated instruments such as pension funds and long-only asset managers.

Corporates and other Commercial End Users (CEUs) have cried foul at SA-CCR’s treatment of non-cash collateral, which is generally posted by these firms. CEUs use the derivatives markets almost exclusively for hedging purposes and have therefore historically been exempt from many of the post-crisis rules that have impacted other firms.

This means that their positions are generally not centrally cleared or subject to the Uncleared Margin Rules. CEUs tend to provide letters of credit or asset liens, which, as far as banks are concerned, are sufficient to significantly reduce counterparty risk, but are treated as unmargined under SA-CCR.

CEUs have been exempted from the uplift of the alpha factor in the US and there is growing pressure on EU regulators to follow suit. However, the typical structure of their portfolios and use of non-cash collateral offsets the benefits of the alpha factor exemption.

The big winners are diversified asset managers, hedge funds and options trading firms. The former two firm types benefit significantly from having multi-directional portfolios, and the latter from the different calculations of options exposures.