In the latest Acuiti monthly survey, we asked our exclusive network of Senior Executives how their business is expected to perform overall in 2020.

The results showed a year of feast and famine for the derivatives industry, as revenues soared and dropped as a result of volatility.

Revenues soared in March and April, as a result of Covid-19 related volatility and investors repositioning portfolios and adjusting risk exposures.

For many in the industry, an entire year’s P&L was made in one or two months and they expected an exceptional year for revenues.

However, as predicted by a Senior Executive participating in Acuiti’s April Insight Report, what followed was a sharp reduction in volatility and a dramatic fall in revenues.

For proprietary trading firms, brokers and some on the buyside, revenues were hit by the reduced volatility and volumes. Clearing firms were faced with a double whammy of lower volumes and the impact of the cuts in interest rates – reducing their ability to make money on funds held as margin.

Some also suffered losses related to clients hit by the volatility.

Therefore, the result of Acuiti’s December report is a mixed bag in terms of revenues for the year.

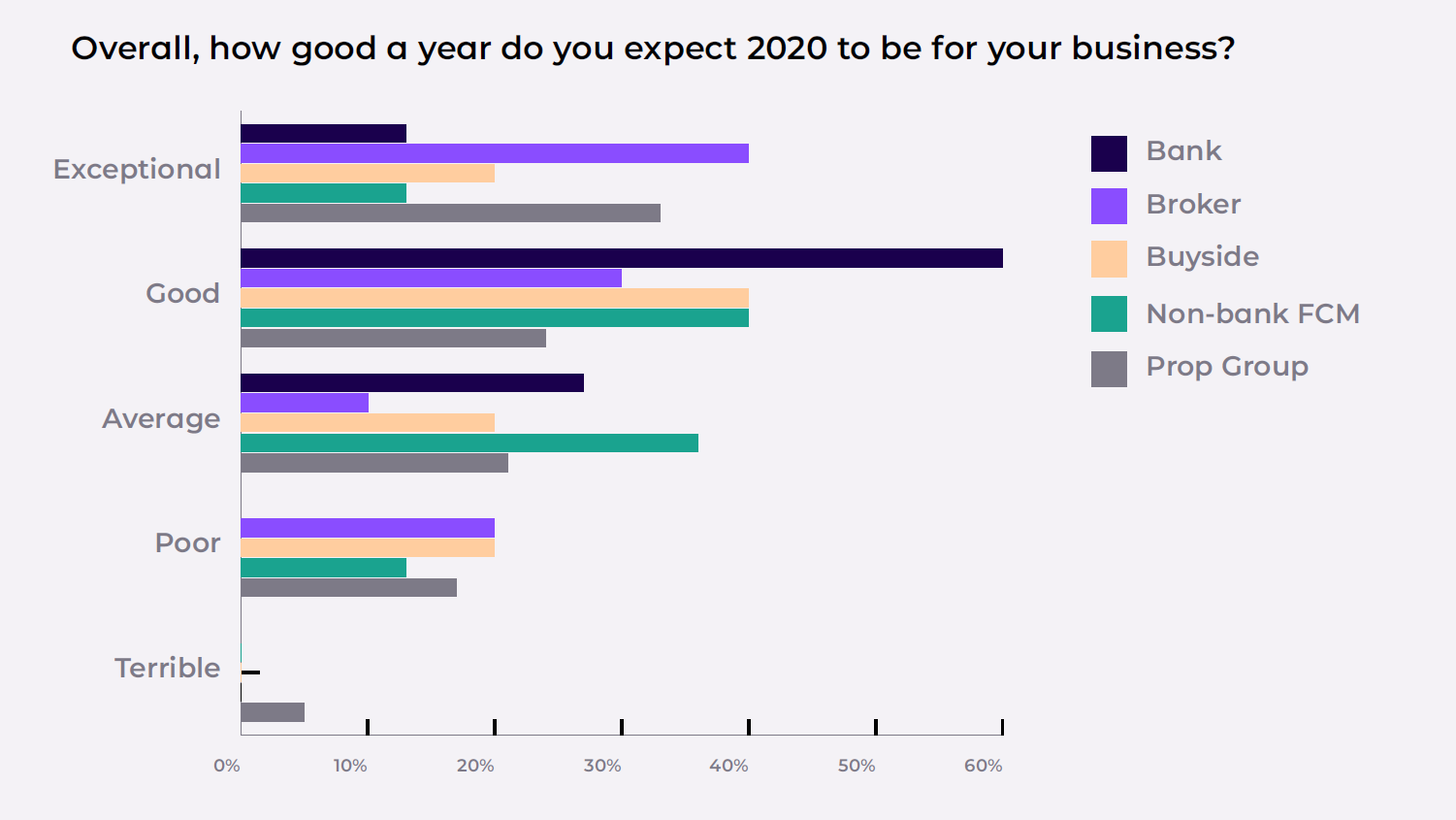

Overall, brokers performed best with 44% of respondents saying they expected this year to be exceptional in terms of revenues. This compares with 33% of proprietary trading firms, 28% of hedge funds, 13% of banks and 12% of non-bank FCMs.

Bank performance was strong, with a further 60% saying they expect 2020 to be a good year compared with 37% of non-bank FCMs, a third of brokers and 24% of proprietary trading firms.

Proprietary trading performance was the most diverse. 19% of respondents said they expected the year to be poor and 5% said it would be terrible.

We also found that small numbers of prop firms got hit by adverse market moves, particularly around March and April and that these losses were not fully recouped despite the improved trading conditions in November.

Click here to download the full report and learn about 2020 revenues by company type, regions and the outlook over the next three months.